| Organization: | Office of the State Auditor Division of Local Mandates |

|---|---|

| Date published: | March 21, 2022 |

Executive Summary

The Commonwealth of Massachusetts continues to pass laws that require significant resources from cities and towns for implementation. These measures are in large part financed by local property taxes as state aid lags behind increasing local assessments. There were several major pieces of legislation signed into law during the period between 2016 and 2020, in addition to legislation with more modest goals and/or effects. Notable legislation included the Municipal Modernization Act, an expansion of the public records law, and criminal justice and policing reforms. This period also saw the passage of the Student Opportunity Act, which promises to increase aid for public education, particularly in school districts with lower incomes, large English-learner enrollments, and higher-cost special-education needs. Moreover, the 2019 coronavirus (COVID-19) pandemic brought special legislation that allowed for flexibility in municipal governance. As a result, voting opportunities expanded, resulting in new costs that were offset, at least in part, by important federal and state reimbursements.

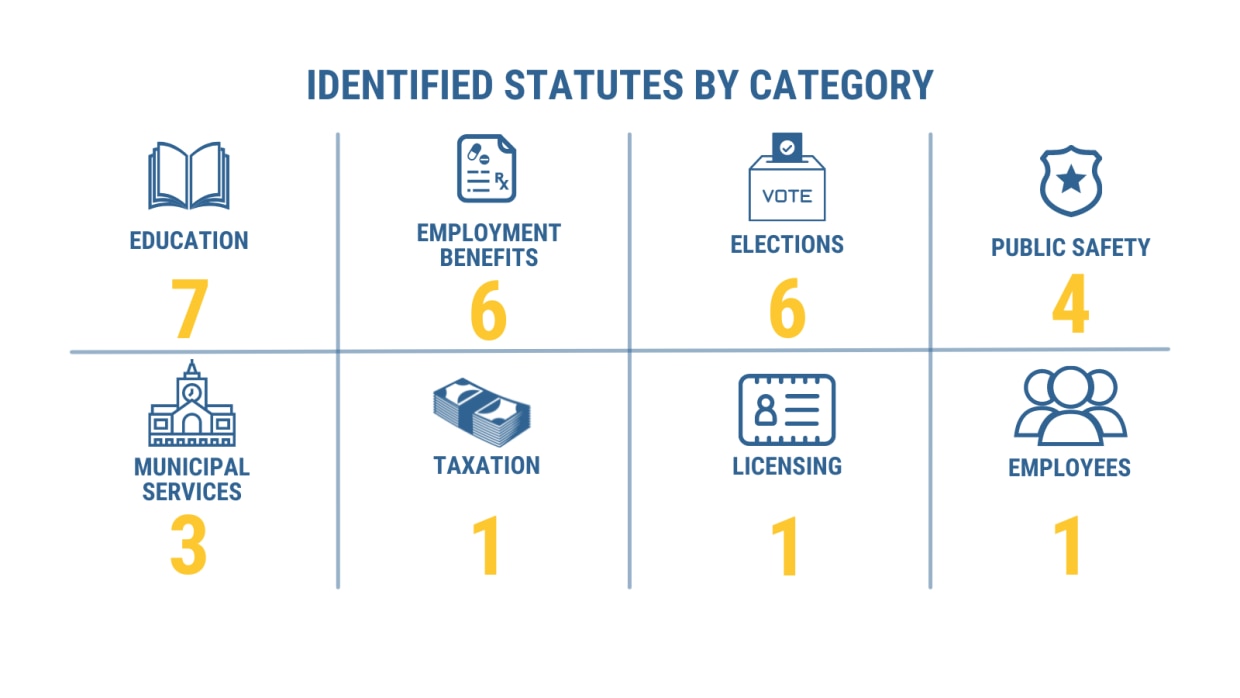

This report is prepared to fulfill the requirement that the Division of Local Mandates (DLM) “shall review every five years those laws and administrative regulations which have a significant financial impact upon cities or towns” in Massachusetts.1 During this period, DLM reviewed 1,629 pieces of enacted legislation and identified 29 statutes which have a substantial impact on municipal budgets and operations. The 29 statutes are categorized in Figure 1 by subject matter. These statutes, which are outlined in this report, were signed into law during the covered period, which included a continued national economic expansion and ended during the COVID-19 pandemic. As shown in the discussion of the Commonwealth’s financial climate, demands for municipal services have risen during this period. Local taxes and other revenues also have risen faster than state aid.

A PDF copy of the Five Year Statutory Review Fiscal Impact Report is available here.

1. M.G.L. c. 11, § 6B. See Appendix A for full text.

Table of Contents

Appendix

Downloads

-

Open PDF file, 3.95 MB, Five Year Statutory Review Fiscal Impact Report (English, PDF 3.95 MB)